High Yield CD Calculator (APY & Yield)

Discover the true potential of your savings. Our powerful calculator instantly projects the future Final Maturity Value and Total Interest Earned on your high-yield Certificate of Deposit.

Calculate Your Certificate of Deposit Returns

Your Projected CD Returns

Total Interest Earned

$0.00

Final Maturity Value

$0.00

Growth Breakdown

Avg. APY %

Term (Years)

Compounding

Total Growth

Yearly Breakdown Table

| Year | Starting Balance | Interest Earned | Ending Balance |

|---|

What is the difference: Interest Rate vs. CD Yield (APY)?

Most banks advertise the Interest Rate, but you actually earn the Yield (APY). The difference comes from compounding frequency.

| Feature | Interest Rate | CD Yield (APY) |

|---|---|---|

| Definition | The simple annual percentage. | The total amount you actually earn. |

| Includes Compounding? | No (Simple Interest) | Yes (Compound Interest) |

| $10k Deposit Example | 5.00% Rate = $500 | 5.13% Yield = $513 |

*Example assumes Daily Compounding. Use the CD Yield Calculator above to see your exact return.

Ready to Find Your Rate?

Now that you’ve projected your earnings, browse our curated list of the best APYs available from top online banks.

View Top CD RatesUnderstanding High Yield Certificates of Deposit (CDs)

Saving money today is not just about setting funds aside, it’s about choosing the right financial tools that help your balance grow steadily and safely over time. High Yield Certificates of Deposit (CDs) have become one of the most trusted options for people who want predictable growth, guaranteed returns, and zero exposure to market volatility. Our High Yield CD Calculator is designed to make this process easier by showing you exactly how your money grows, how compounding works behind the scenes, and how different terms and APYs affect your long-term financial results.

Whether you’re new to CDs or already familiar with deposit accounts, this guide provides a complete overview so you can make smarter financial decisions.

Why High Yield CDs Matter in Today’s Economy

Economic uncertainty has pushed many individuals to look for safer investment options. Unlike investments tied to the stock market, a CD provides guaranteed interest, FDIC-insured security, and predictable returns. Many high-yield CDs offer significantly better rates than regular savings accounts, especially those from online banks and credit unions.

With interest rates fluctuating frequently, having a tool that gives you precise, instant projections is more important than ever. A small difference in APY or compounding frequency can dramatically change your final maturity value over 5 or 10 years.

How CD Compounding Works: The Math Behind the Growth

Most people assume that CD earnings depend only on APY. In reality, compounding is what makes your balance grow faster. Compounding means your interest earns more interest every month, quarter, or year.

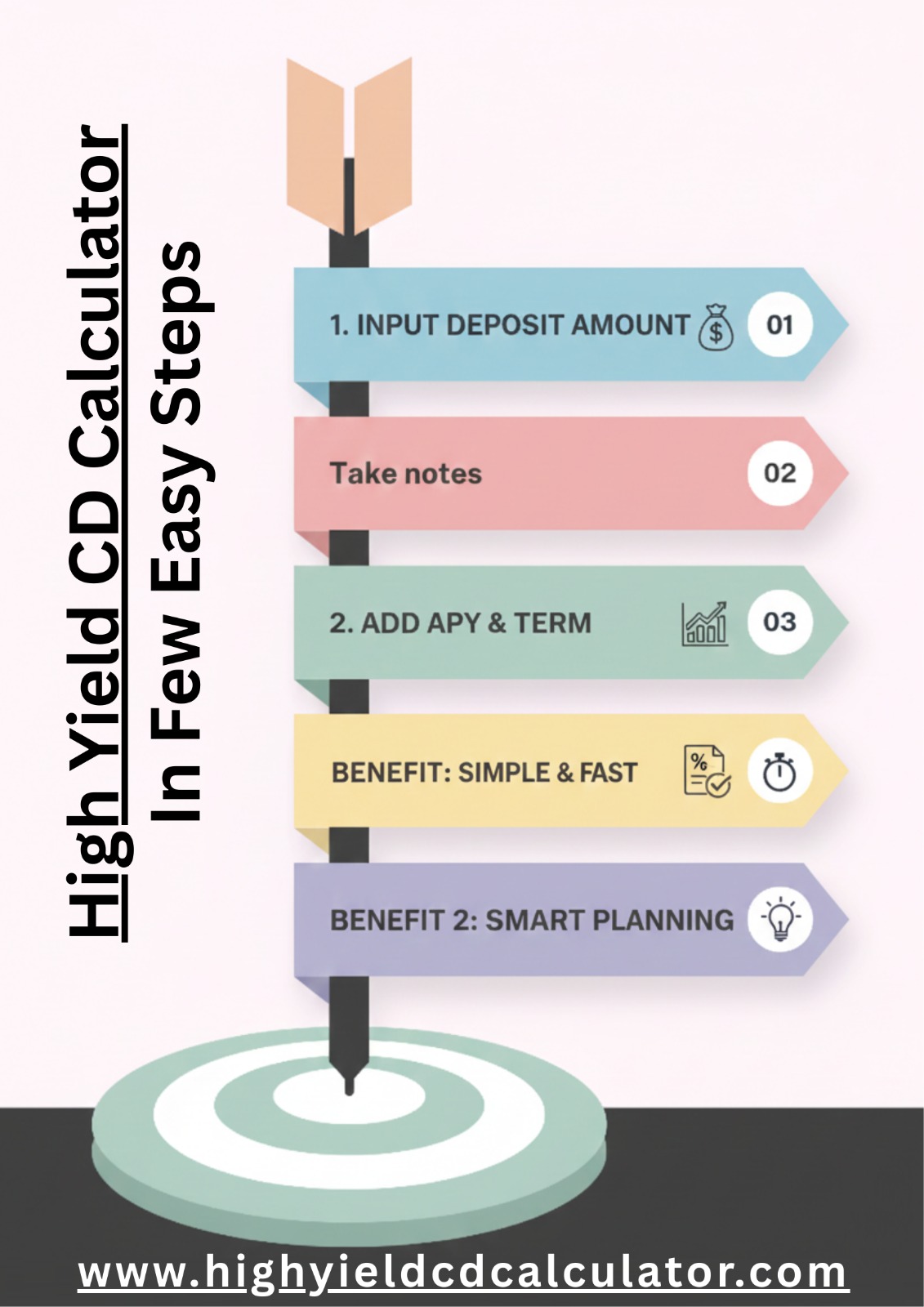

How to Use This Calculator

Visualize your financial trajectory with this growth analysis infographic. It illustrates how an initial deposit grows over time through compounding, showing the distinct breakdown between your principal, total interest earned, and final maturity value. Use this visual aid to understand the true power of long-term, high-yield savings strategies.

For example, if you invest $10,000 at 5.00% APY for 5 years:

- Simple Interest: You would earn exactly $2,500 ($500 per year).

- Compound Interest: With monthly compounding, you earn interest on your interest. After 5 years, you end up with significantly more because your balance increases every period.

Our calculator uses the precise formula $A = P(1 + \frac{r}{n})^{nt}$ to ensure every penny is accounted for.

Advanced Savings Strategy: The CD Ladder

One of the smartest ways to manage High Yield CDs is through a CD ladder. This approach splits your money into multiple CDs with different maturity dates. Instead of locking your entire savings into one long-term CD, you spread your deposit across 1-year, 2-year, 3-year, 4-year, and 5-year terms.

Benefits of a Ladder:

- ✓ Liquidity: One CD matures every year, giving you access to cash without penalties.

- ✓ Rate Capture: You can reinvest maturing funds into new CDs at current top rates.

- ✓ Flexibility: It balances long-term growth with short-term needs.

Tax Implications: What to Know Before You Earn

Interest earned on standard CDs is generally considered taxable income in the year it is added to your balance, even if you don’t withdraw it. At the end of the year, your bank may send you a Form 1099-INT showing your earned interest.

Individuals in higher tax brackets sometimes choose CDs held inside tax-advantaged accounts such as IRAs. In these cases, interest may grow tax-deferred until retirement.

Inflation and Real Rate of Return

When evaluating rates, consider inflation. If a CD pays 5% APY but inflation is 3%, your real rate of return is closer to 2%. High Yield CDs are excellent vehicles for low-risk growth, but understanding inflation helps you choose the right terms for long-term goals.

Disclaimer: This tool is for educational purposes. While we strive for accuracy, bank terms vary. Always verify the APY and compounding schedule with your financial institution before depositing funds.

Frequently Asked Questions

The interest is calculated using the compound interest formula: A = P × (1 + r/n)^(nt). Our calculator uses the initial deposit (P), the Annual Percentage Yield (r), the compounding frequency (n), and the term length (t) to determine your final value.

The Annual Percentage Yield (APY) is the effective annual rate of return, including the effect of compounding. The simple Interest Rate (APY) (or nominal rate) is the stated rate before compounding is taken into account. When comparing CD offers, the APY is the most important number because it reflects the true amount you will earn.

Yes. Certificates of Deposit (CDs) penalize you for taking money out before the maturity date. This penalty is typically the loss of a certain number of days’ worth of interest. Always verify the penalty structure with the financial institution before opening a CD.